DeFi Analytics Platforms

Having a system of decentralized finance has naturally given rise to tons of new applications that are able to track every single metric there is thanks to the openness of blockchain. Having an open database for tracking financial metrics is something that is rarely available in traditional financial markets, much less for free. If someone wants to track designated financial metrics of public companies, they have to pay for costly subscriptions for services such as Bloomberg Terminal to view them. Even then, however, there is a ton of financial data that users can’t view about public companies.

Blockchain is able to create a fair and open system for tracking every metric possible within the world of decentralized finance, which lets users have unfiltered access to raw financial data.

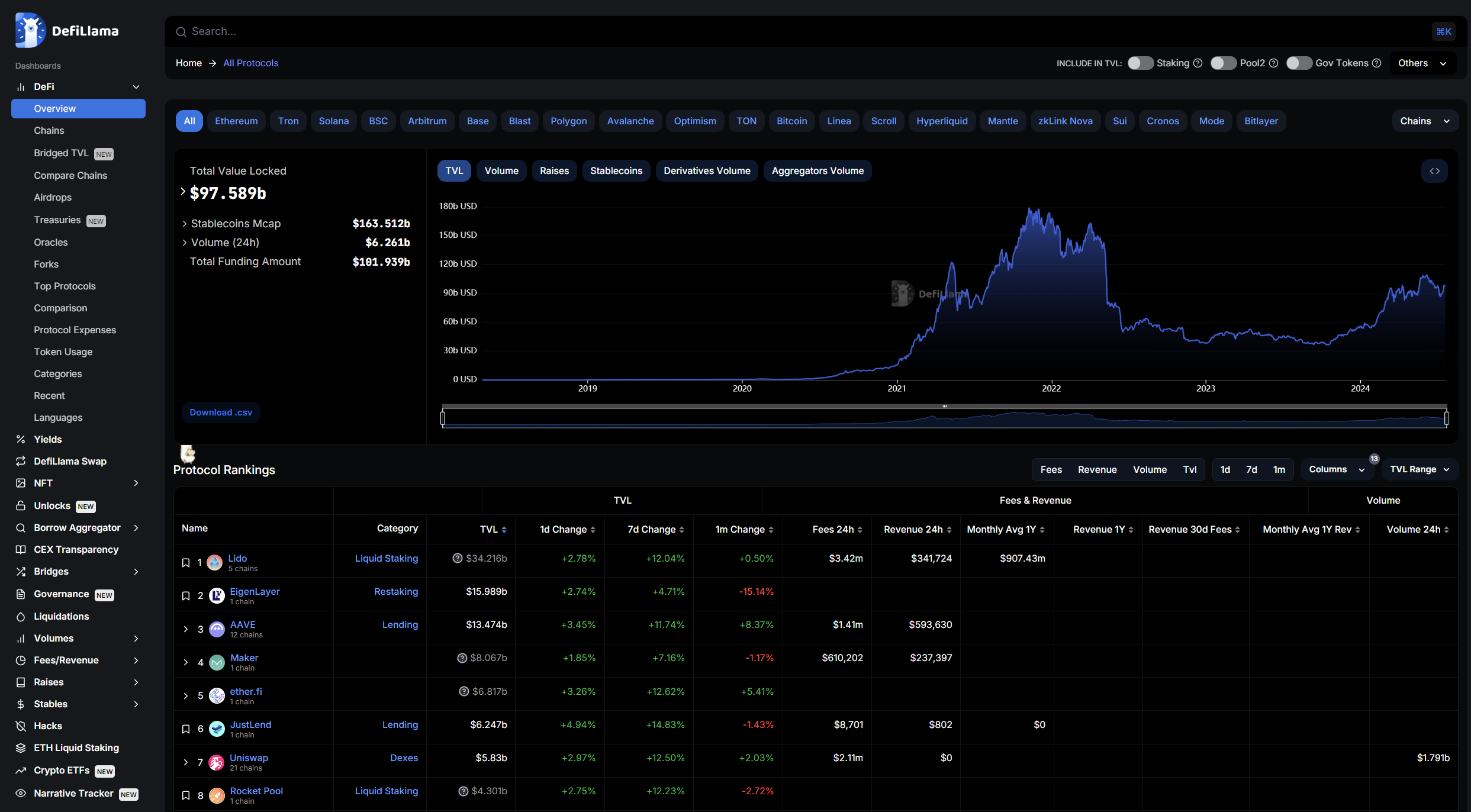

Source: DefiLlama

One of the most popular and useful applications to be familiar with is DefiLlama, a comprehensive analytics and research platform that tracks the values of all existing DeFi protocols. It provides essential data for tracking the performance of the DeFi market by showing the movement of money across different protocols and how well each one is performing.

DefiLlama includes data on all sorts of metrics including (click on each link to view the metric in DefiLlama):

…and so much more. Users are able to search any project in the DeFi space to determine its performance based on all these given metrics, making DefiLlama an essential on-chain research tool.

DefiLlama also has a very active community, and the app is constantly being updated to track the metrics of newly deployed applications in DeFi. Anytime a new project launches and begins gaining any traction, DefiLlama will immediately begin tracking it. DefiLlama is also fully open source and is maintained by teams from hundreds of different protocols.

To learn more about how to effectively use DefiLlama, check out this article by Milk Road on how to use DefiLlama to boost your DeFi research.

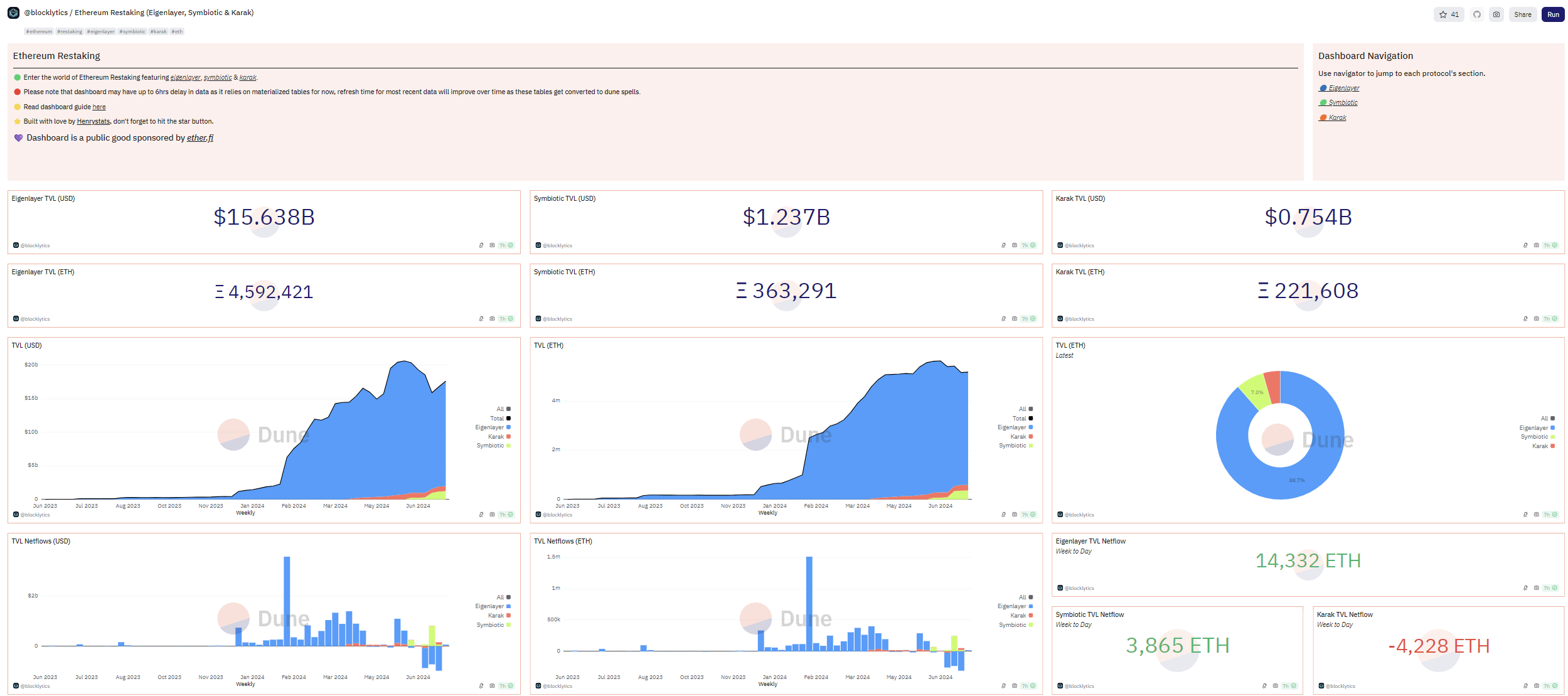

Another popular tool for tracking on-chain data is Dune, an application that lets users create custom dashboards using the SQL programming language, which is highly popular amongst data analysts.

Dune offers a high level of customization for its users, where anyone can create a custom dashboard using SQL queries and share it with others. Similar to DeBank, this platform follows the idea of being an on-chain social graph, where users can create and share their own dashboards. Users can create custom dashboards to track specific metrics or view any of the thousands of dashboards available on the platform.

This dashboard, for example, is custom built to track Ethereum restaking. It evaluates data from 3 different restaking protocols: Eigenlayer, Symbiotic, and Karak. These protocols are popular for restaking staked ETH, and this dashboard tracks metrics such as TVL, inflows, liquidity, and volume. Check it out for yourself here.

Source: Blocklytics on Dune

Having a platform that lets you create custom dashboards for tracking on-chain financial metrics is something that is only possible thanks to the data availability of blockchain. Anyone can go and write custom queries to view any metric they’d like, creating a highly effective way to analyze DeFi trends.

Check out this useful documentation on Dune to learn how to build your own custom dashboards.

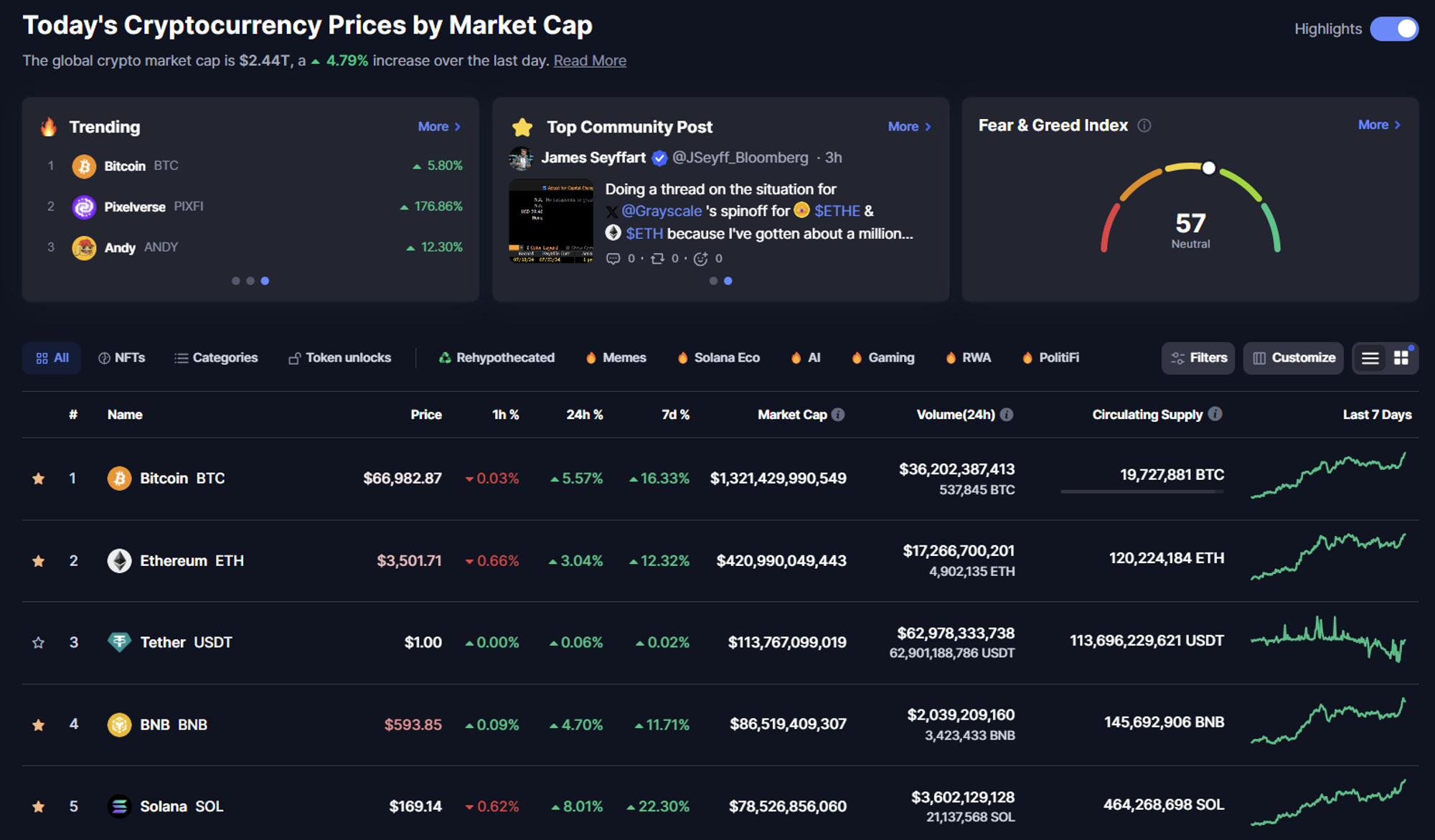

CoinMarketCap and CoinGecko are two useful applications for tracking cryptocurrency prices and market capitalizations. These platforms offer an extensive suite of tools for everyday use within the cryptocurrency ecosystem.

These platforms both offer:

- Real time price tracking and historical price data

- Market rankings and overview for individual tokens as well as for the crypto market as a whole

- Filters to track tokens by project categories (gaming, AI, etc.)

- Centralized and decentralized exchanges and their key metrics

- Custom portfolio tracking tools for monitoring your wallets

- API resources for pulling price data for custom applications

- Educational resources for learning cryptocurrency terms and concepts

…as well as other great tools. CoinMarketCap also contains a live crypto version of the Fear and Greed Index. This index acts as a live tracker of market sentiment, and provides a live score of 1-100, with 1 being extreme fear and 100 being extreme greed. A low score on the index means that the market is in a fearful sentiment and more people are selling than buying, while a high score indicates the opposite.

Source: CoinMarketCap

Check out the CoinMarketCap Academy for tons of articles and insights about the application and the broader crypto market.

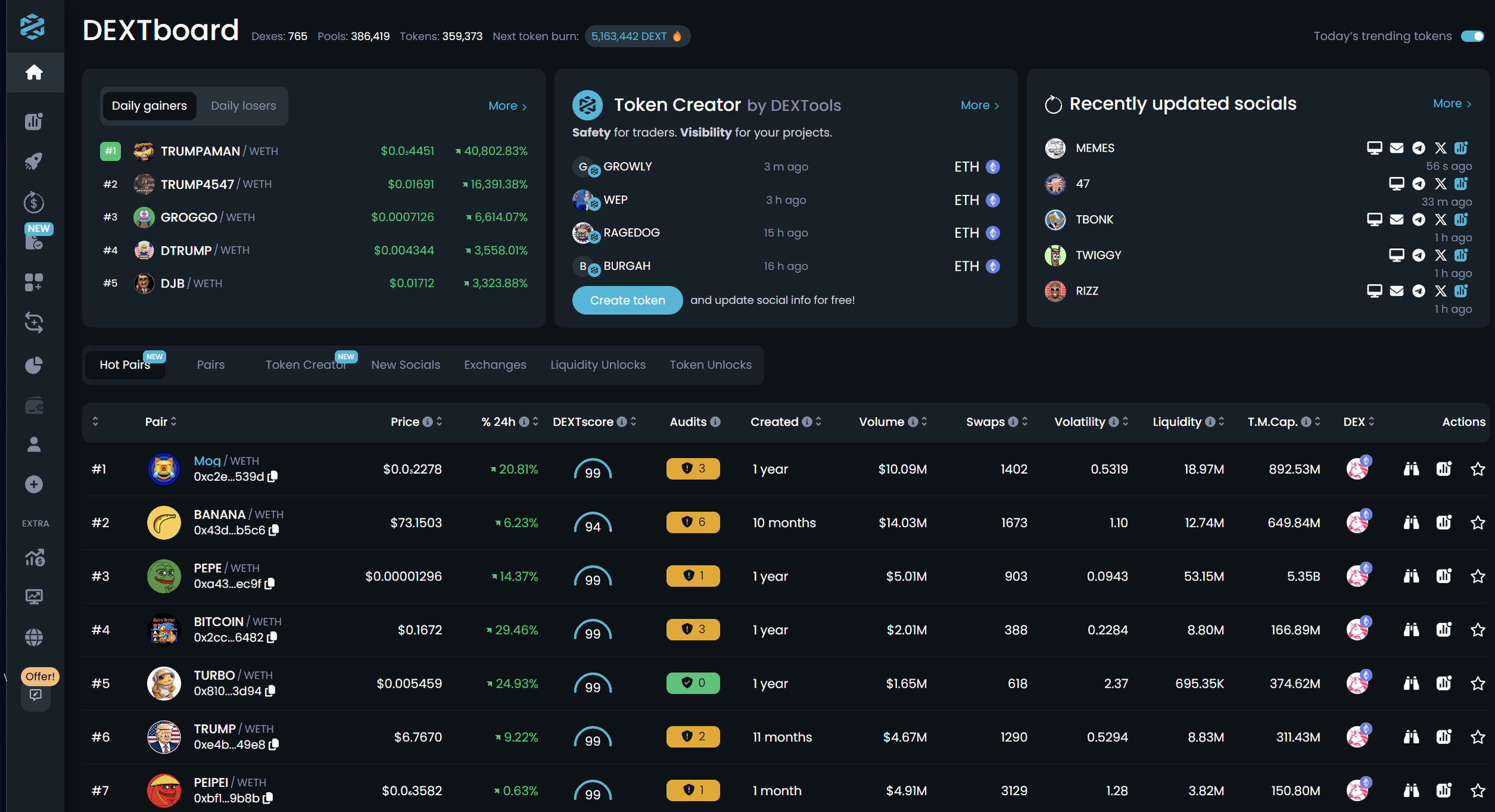

One more useful application for tracking DeFi metrics is DEXTools, a platform dedicated to tracking token volumes on decentralized exchanges (DEXes). It’s primary purpose is to track active token pairs on these exchanges to let users stay up to date on the most popular pairs.

This application is able to give users a higher level of insight into each token pair so that they can effectively analyze it. With new tokens appearing in the DeFi world on a daily basis, DEXTools offers insight into trading data that would otherwise be difficult to find on other platforms such as CoinMarketCap, which only start tracking token metrics once it reaches a certain amount of volume or popularity.

Source: DEXTools

This is protocol is especially useful for traders and investors that want to buy into projects at a very early stage before they become too popular and start losing upward price momentum.

For each trading pair, DEXTools provides:

- Price data

- Contract addresses for the tokens as well as their liquidity pools

- Volume, market cap, circulation, and volatility metrics

- A custom DEXTools community trust rating and other safety information to avoid scam tokens

- Social media and website links to the project

To learn more about how to use DEXTools and all its offerings, check out the DEXTools Academy YouTube channel.

These tools are just a few of the many different applications that exist in the blockchain world. New apps are constantly being released and old ones are being updated as blockchain technology continues to evolve at a rapid pace. Make sure to stay up to data on all the available tools and how they can help you navigate the blockchain ecosystem.

📋 Practice Question