Liquid Staking

A big part of network liquidity and security is staking. While chains such as Ethereum utilize Proof of Stake, where node operators can stake ETH to contribute to the network, not everyone can meet the criteria required or want to take on that level of commitment. Becoming a node validator on Ethereum requires putting up 32 ETH, which is roughly $115,000 as of June 2024, as well as storage space and some computing power.

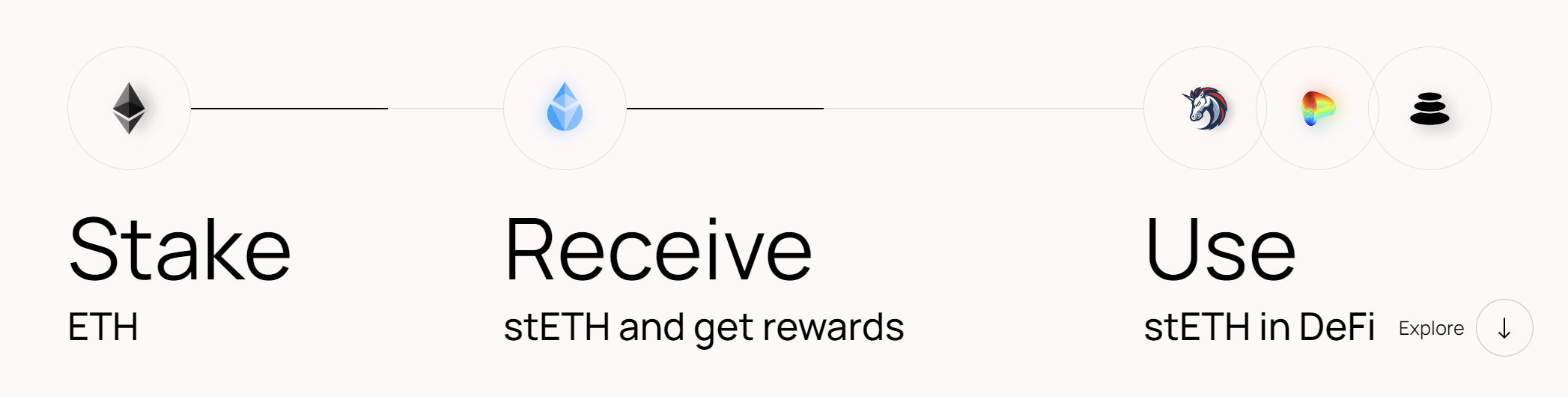

A solution that arose to this issue is the rise of liquid staking, where anyone can contribute any amount they’d like to securing the network in exchange for interest on their holdings. Liquid staking works by letting people pool their assets together to cover the cost of operating a node.

Instead of one person putting up the required stake amount and running a node themselves, liquid staking protocols let users deposit funds into a pool and then use those funds to operate nodes.

What’s even better is that users that stake their assets then receive liquid staking tokens, or LSTs, that are interest bearing tokens that represent the value of your stake plus the interest accrued. These LSTs can then be used across the DeFi ecosystem to earn additional yield or as collateral on lending protocols such as Aave. Some protocols have begun to offer Liquid Restaking Tokens, or LRTs, that are given in exchange for staking LSTs.

Source: Lido

The rise of LSTs has led to tons of different protocols in DeFi offering the ability to stake assets on their platforms in exchange for yields. Liquid staking benefits both the project and the users: on the project side this system offers increased decentralization, where protocols can rely on users to generate liquidity, while the users have a way to continuously engage with a protocol while earning rewards.

💡 Example of Liquid Staking on a protocol

Pendle is a fully permissionless, decentralized protocol that enables users to maximize their potential return on their digital assets. They offer fixed yield strategies for users to get fixed rate returns on their staked assets. Pendle’s token is called PENDLE and lets holders of the token participate in the protocol. However, the protocol has the option for users to stake their PENDLE tokens in exchange for vote-escrowed PENDLE, or vePENDLE. Users can lock their PENDLE to receive vePENDLE, where the amount of time its locked for is proportional to the rewards - the longer you lock your PENDLE, the more vePENDLE rewards you will receive.

vePENDLE offers a ton of additional value to users, including:

- Increased voting power

- A base APY as well as an additional Voter’s APY

- Increased liquidity pool rewards for farming yield

This system benefits both the Pendle protocol and its users. It creates liquidity for the Pendle protocol by directly incentivizing users to lock their money for a set amount of time in order to accrue rewards. It creates additional value for the PENDLE token, where a user must buy PENDLE in order to stake it and receive vePENDLE, which drives demand for the PENDLE token.

For more information on how this system works, check out the Pendle docs on vePENDLE.

Lido is the most prominent liquid staking protocol in DeFi, with over 32 billion dollars (as of June 2024) staked. Lido works by letting users stake their ETH and giving them stETH in return. This is the LST of the protocol and automatically accrues interest for the user. All you have to do is deposit any amount of ETH and receive the equivalent in stETH, and you will now be helping secure the Ethereum network! You can then unstake your stETH at anytime in exchange for ETH.

Lido takes all of this staked ETH and pools it together to operate nodes. The more ETH is deposited, the more nodes they can run. Interest accrued from operating all these nodes is what generates the yield that is given to the stakers in the form of stETH. This model allows users that want the staking rewards ETH has to offer, but don’t want to go through the hassle of becoming a node validator on the network, to still contribute their ETH.

Liquid staking has also created a method of tracking a protocol’s value through its TVL, or Total Value Locked. The TVL of a protocol highlights the amount of assets that a protocol has locked on it and can help define the risks and benefits of investing in a certain platform. Generally, the higher the TVL of a protocol, the more trustworthy it seems, since it shows investors that others trust this project and are willing to lock their money on it. For more information on how TVL works, check out this Investopedia article.

When staking cryptocurrency it’s important to check all of the details before locking your assets on a protocol. Ensure that:

- The protocol you are using is trusted by others in the crypto community

- There are clear guidelines for how and when you can unlock your staked assets

- The smart contracts the protocol uses are secure and audited, which decreases the likelihood of the project getting hacked

📋 Practice Question