Tracking Onchain Addresses

While blockchain explorers offer a lot of value, it’s not the most ideal way to track public wallets. Blockchain offers a veil of semi-privacy to wallet addresses, where only the public key itself is revealed and not the real identity of its holder. However, through on-chain snooping and transaction tracking, it’s possible to figure out who is behind a wallet’s address. This is useful for tracking public entities that buy crypto and can include the accounts of centralized exchanges such as Coinbase, public figures that claim to hold crypto themselves, and even government owned wallet addresses.

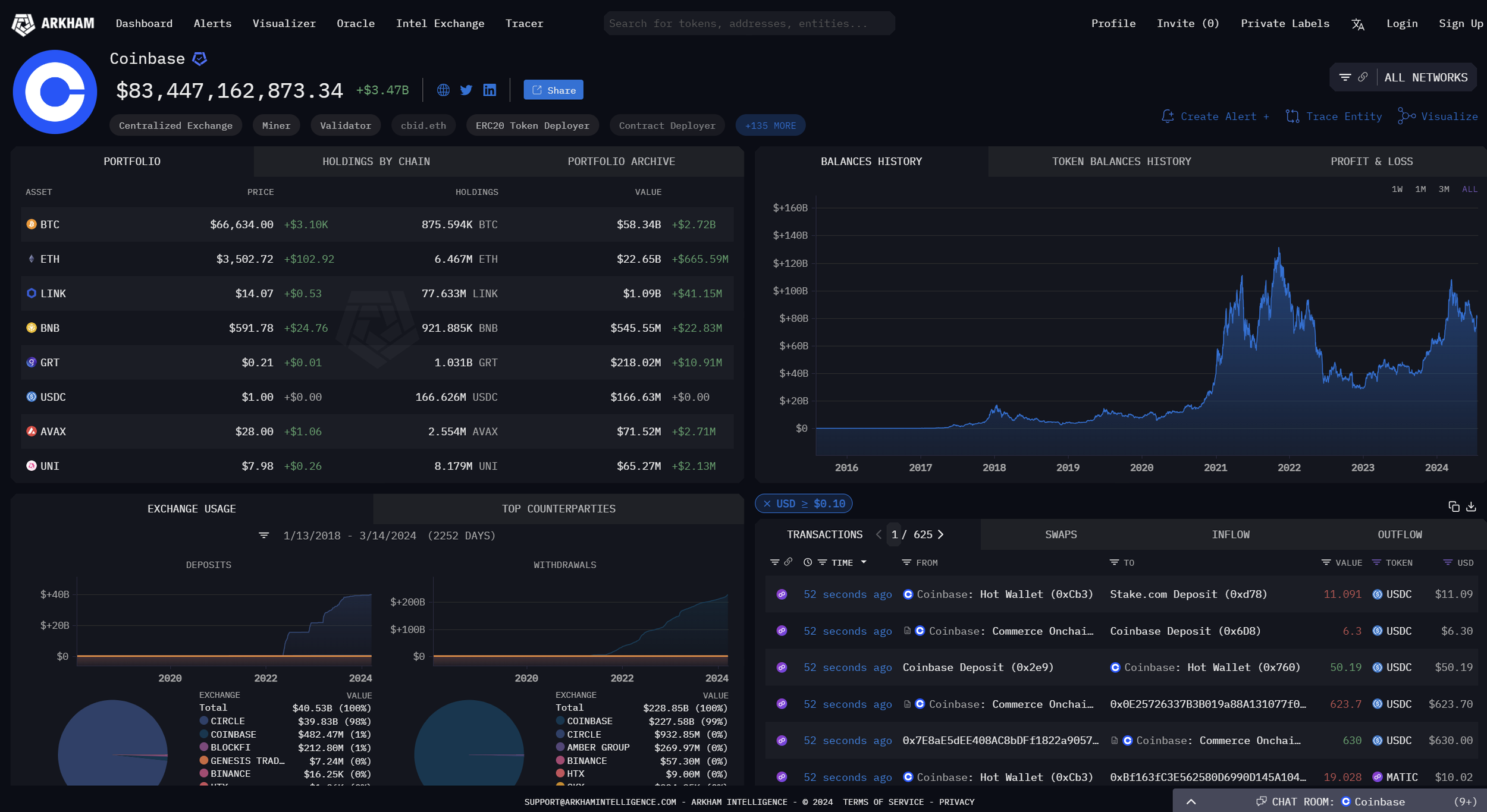

Source: Arkham Intelligence

On-chain address trackers are great for monitoring and analyzing public addresses. They provide insight into metrics such as:

- Transaction history of an address

- Lists of tokens held and their balances within the address

- Interaction with other addresses

One great tool for tracking these entities is Arkham Intelligence, a popular system who’s goal is to deanonymize the blockchain. Arkham is responsible for tracing public wallet addresses in order to determine who they belong to. This will help create a system of accountability, where bad actors can no longer hide behind private addresses to conduct malicious transactions, and exchanges can be held fully accountable for their funds because their holdings are fully visible on-chain.

Arkham is able to trace tons of information regarding any on-chain address including a complete list of transactions, all of the wallet’s holdings, usage metrics, and more. It also allows users to create custom dashboards to track different addresses. For example, searching for Coinbase will reveal this dashboard that contains all of the metrics given about the exchange. Arkham is able to determine the true owners of on-chain addresses by tracking the movements of funds from known wallets and creating a trail from that address’s transactions.

To learn more about how to use this platform effectively, check out CoinMarketCap’s beginners guide to Arkham Intelligence.

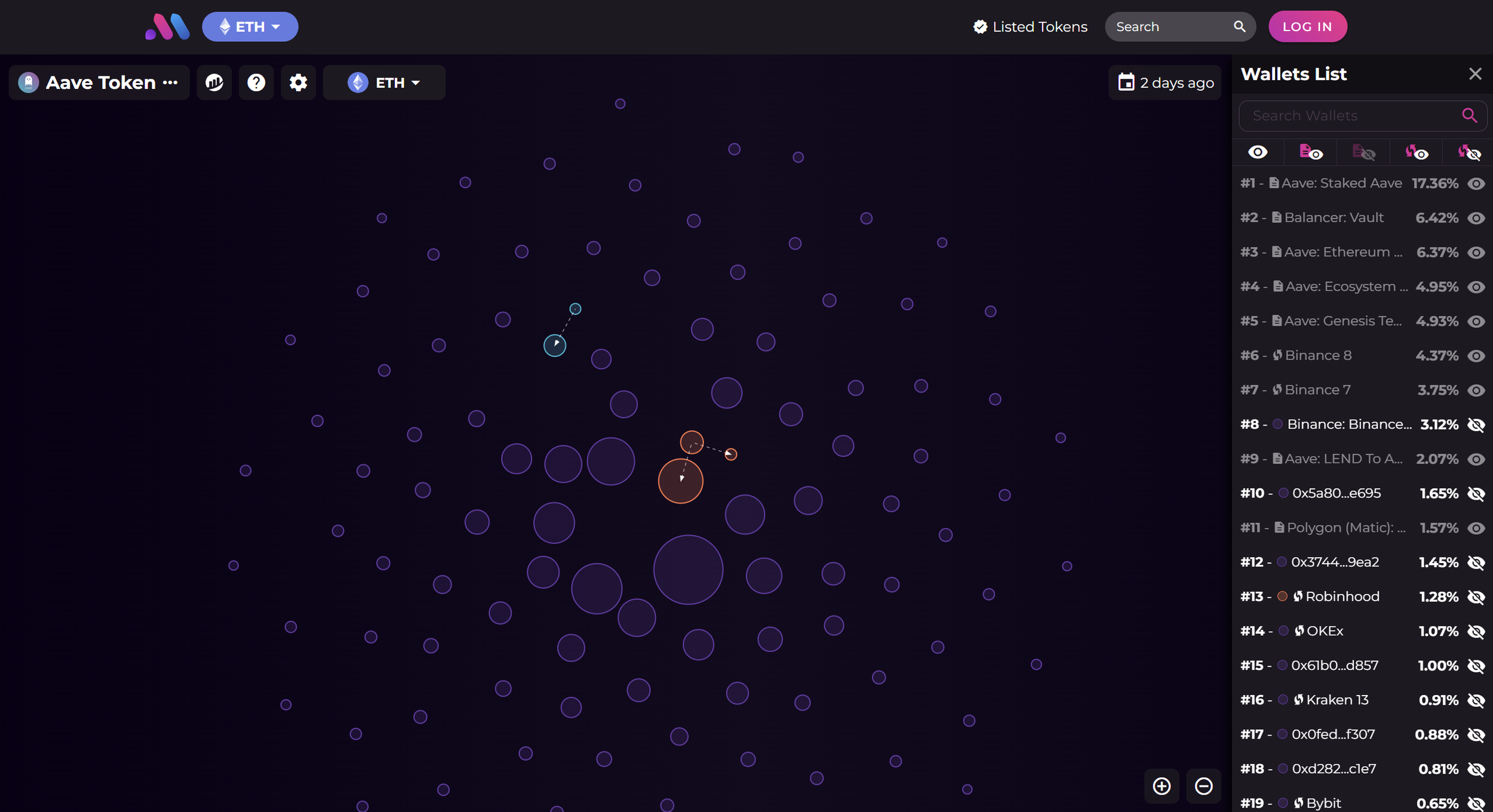

Arkham also offers tons of data visualization options for users to utilize to better organize the data into a more readable format. This system goes hand-in-hand with Bubblemaps, another wallet tracking site that offers users a less in-depth and more visually appealing platform to track addresses. Bubblemaps works by creating an interactive bubble map to illustrate addresses and their token holdings. This lets users literally see token distribution patterns, as well as identify linked wallets, and who holds what percentage of the supply.

For example, this image illustrates a Bubblemap for the AAVE token. Each bubble on the map proportionately represents a large wallet holding AAVE, with bigger bubbles holding larger percentages of the total supply. This tactic is useful for determining how many addresses hold and control the supply of a token, since these addresses would be able to dump tokens at any time and cause a drop in the price.

💡 Tricking on-chain metrics

Many scam projects attempt to trick those tracking token metrics by splitting up their holdings into multiple wallets. When looking at a token’s distribution, it’s usually a red flag to see one address holding a large percentage of the token supply (unless it’s the project’s treasury). By separating funds into multiple wallets, a scammer can make it seem as if this is not the case and the token is normally distributed.

Protocols such as Bubblemaps aim to combat this issue. They are able to determine whether multiple wallets are controlled by the same entity and alert users if this is the case.

Source: Bubblemaps

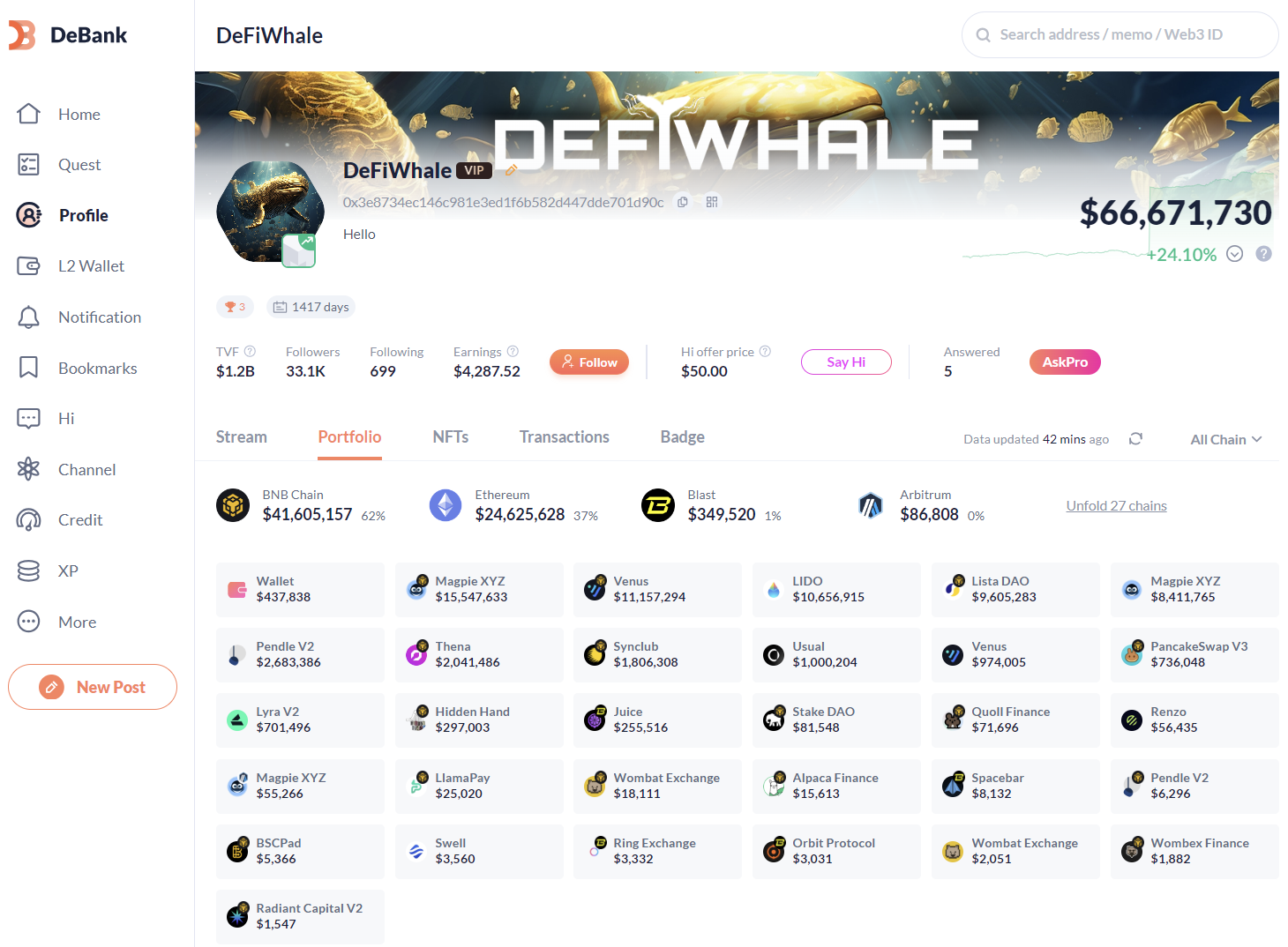

Instead of being tracked down by the likes of Arkham Intelligence or numerous on-chain detectives, DeBank gives users the ability to turn their wallet into a publicly facing profile that is connected to their social media accounts. Users are able to search wallet addresses directly and view their holdings. This image, for example, is of the account DeFi Whale and illustrates their wallet activity. These accounts are then able to gain and interact with followers through posts while at the same time openly showing and promoting projects they are involved in. Users can showcase:

- Token holdings and balances

- Their activity on various blockchains

- Involvement in specific protocols (ex. staking on Pendle)

- NFTs

This social graph lets users create a truly public identity that revolves around an on-chain address while at the same time giving others the ability to see what projects people are involved in and learn more about them. Crypto influencers can utilize platforms like DeBank to showcase themselves and the projects they support.

Check out Bubblemaps case studies to see real examples of how Bubblemaps was able to detect on-chain fraud and track down interconnected wallets to expose the truth behind various protocols.

Wallet tracking has become a big part of DeFi, with many users looking to profit off of tokens by tracking the movements of famous crypto traders or large token holders. This has become such a phenomenon that a whole social network was created for this purpose: DeBank.

Source: DeFi Whale on DeBank

📋 Practice Question

If you search a token on Bubblemaps and it shows that 3 related wallets hold 15% of the token supply (and none of those wallets are the project’s treasury), it is likely a:

To learn more about how to use DeBank to its full capacity and track the portfolios of various projects, check out this article by Stakingbits that covers advanced DeBank tactics.