Operating Blockchain Networks

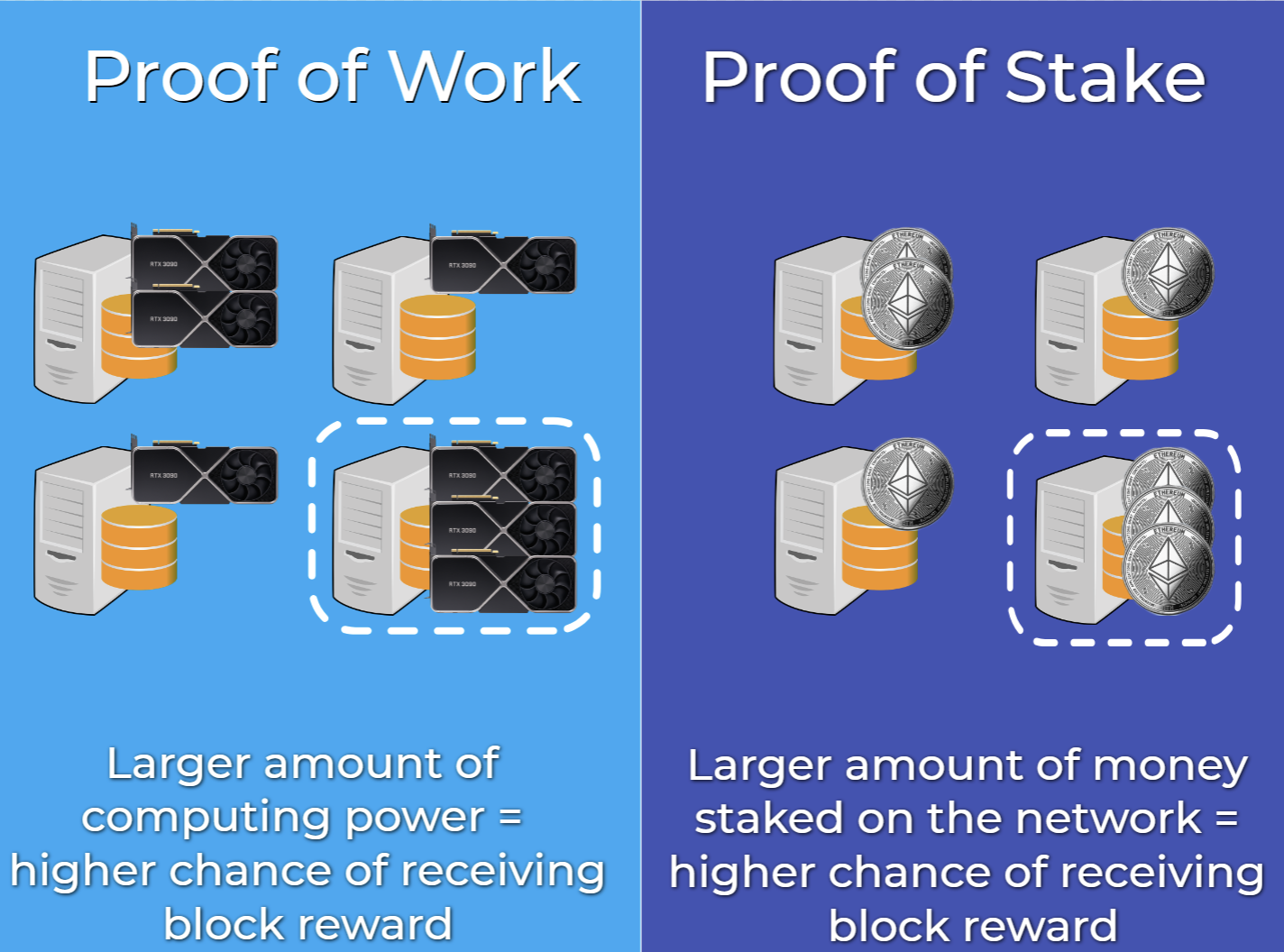

The process of minting, or creating, new cryptocurrency varies from network to network because not every network utilizes mining as the way to validate transactions. The actual term for mining is Proof of Work, or proving the validity of transactions through computing power; on the Bitcoin network, the more computing power you have, the more money you make.

A network such as Ethereum utilizes a completely different mechanism for verifying blocks called Proof of Stake, or staking. Instead of delegating computing power, node operators delegate at least 32 ETH to become a transaction validator. A validator is then chosen at random to approve a block instead of everyone competing to mine it first; the more money a validator has staked, the more likely they are to be picked to propose a new block and get the block reward. Since not everyone is attempting to mine a block at the same time, Proof of Stake is much less compute intensive and requires around 99% less energy to upkeep the network, making it significantly more environmentally friendly than Proof of Work where everyone is trying to use as much computing power as possible.

If you are a malicious validator and attempt to submit a false transaction or bring harm to the network, the violation will be detected by the other validators and your stake will be slashed. Slashing means that a portion of your staked ETH will be permanently taken away, with the amount being determined by the severity of the action. Slashing is critical for system integrity and is what keeps bad actors from submitting false data and manipulating the network.

Source: DCFT

💡 When to use ETH vs Ethereum

It is important to note that Ethereum is the name of the network, while ETH is the name of the token. Similarly, BTC is the token for the Bitcoin network, and SOL is the token for the Solana network.

The Ethereum network does not have a fixed token supply, a halving, or a fixed block reward. Instead, it has a fluid block reward amount that is calculated based on how busy the network is. Ethereum is significantly faster than Bitcoin, with the time to create a new block only being around 12 seconds. When an Ethereum validator proposes a new block and it gets approved, they get a base reward for submitting a correct block plus a portion of the transaction fees that the users paid to use the network.

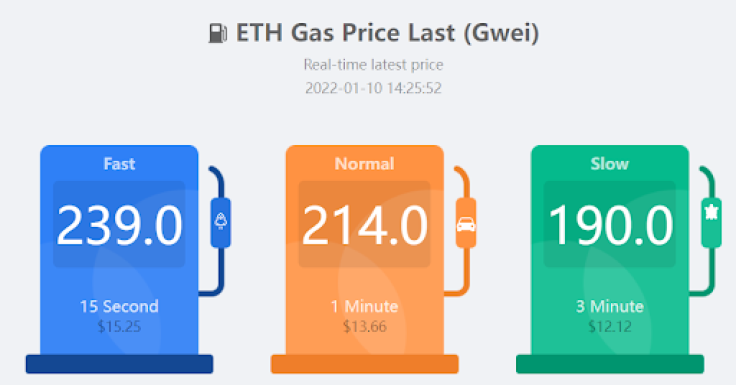

While it does not have a fixed supply, ETH is still deflationary thanks to EIP-1559. This was a proposal (EIP is short for Ethereum Improvement Proposal) implemented in August of 2021 that created a burn mechanism that is responsible for removing, or burning, a fixed supply of tokens from circulation for every transaction that occurs. It split a transaction fee into 2 parts: a base fee, and a priority fee. The base fee is a fixed amount that is determined based on how busy the network is, and it is removed from circulation once the transaction is complete. The priority fee acts as a tip to the validator, where the higher the fee, the more likely your transaction is to be processed faster. The gas fee is shown in Gwei, which is a small fraction of ETH (think a fraction of a cent compared to a dollar).

💡 Fee structure on blockchain

Imagine you are calling an Uber. There is a fixed amount you must pay the driver (the base fee), but you can also offer a large tip (the priority fee) to make sure you get chosen over other riders.

Source: IBT

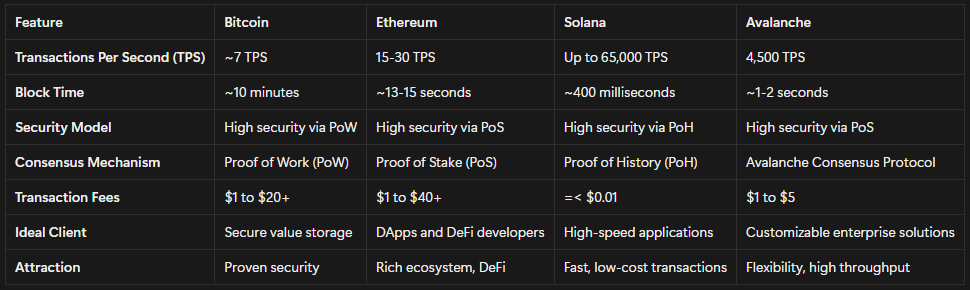

Let’s compare some popular blockchain networks.

Different networks offer varying pros and cons, which can attract different clientele. Let’s take a look at how 4 different blockchain networks stack up against one another:

Source: DCFT

Bitcoin Network

Bitcoin is generally considered the most trusted network since it is the original cryptocurrency. Its beauty is in its simplicity, where users are only able to complete peer-to-peer transactions. It is truly completely decentralized, making it an ideal store of wealth for its users. Many people today call it ‘digital gold’ because it’s an asset that’s capable of beating inflation and cannot be manipulated by external forces such as governments. Its native currency is BTC and is the only cryptocurrency that can be used on the network. While it’s ideal for storing wealth and conducting peer-to-peer transactions, Bitcoin’s high fees and slow block time make it less ideal for more advanced function.

Ethereum Network

The Ethereum network truly gave birth to the world of decentralized finance. It has an extensive ecosystem that has a strong developer community that has created tons of robust smart contract applications that cater to investors. While it is not as decentralized as Bitcoin, its PoS mechanism gives it enhanced security and network support. Most other chains are built to be compatible with Ethereum in order to have access to its liquidity, ecosystem, and community. While its native currency is ETH, the Ethereum network’s smart contract capabilities allow it to support tons of other cryptocurrencies that can be deployed on the network. While its PoS mechanism makes the network secure, it’s currently not as ideal for applications that rely on a high TPS rate to conduct fast transactions.

Solana Network

The Solana network is capable of reaching blazing fast speeds, making it ideal for applications that need super fast and super cheap transactions. It’s able to reach such high speeds due to its Proof of History consensus method, which works by creating a unique timestamp for every single transaction that has occurred, giving it verifiable proof of the history of events on the chain (more on this in the 5. Blockchain Ecosystem Infrastructure section). This system also allows users to essentially pre-order transactions that can be quickly validated in sequence since the chain knows exactly when each one occurred. Its native currency is SOL, and like the Ethereum network, it is capable of supporting other currencies. This system is ideal for applications with high frequency transactions, including gaming and trading but its high throughput speed sometimes causes complications on the network resulting in outages.

Avalanche Network

Avalanche works in a unique way using something called a Directed Acyclic Graph (DAG) structure. This DAG structure lets the network organize all incoming transactions in a way where they can be processed in parallel to one another instead of one at a time. This process greatly increases the efficiency of the chain and makes it ideal for enterprise level applications that need a high throughput (transaction rate). Avalanche allows developers to create more customizable experiences that are ideal for bigger businesses that want to develop a wide range of applications. Its native currency is AVAX, and like Ethereum and Solana, it can also support other currencies.

📋 Practice Question