DeFi Lending

Stablecoins provide another major use case, which is that they are able to be taken out as loans. Loans in the DeFi realm operate with much less restrictions than financial institutions do. Anyone can access liquidity at anytime with minimal restrictions. You do not need any form of identification, tax information, or financial documents, only a digital wallet and cryptocurrency as collateral.

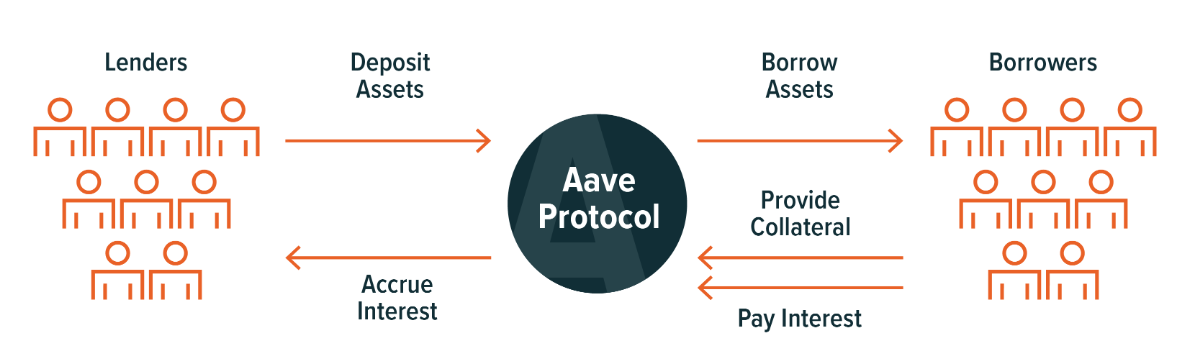

A prominent example of DeFi lending is the Aave protocol, which is an entirely decentralized ecosystem that allows users to act as either borrowers or lenders.

Source: Global X ETFs

How does lending work in Aave?

Lending on Aave works using Liquidity Pools which are smart contracts that are able to store cryptocurrency. These liquidity pools allow for a system where lenders are able to deposit assets into the pool and borrowers are then able to borrow those assets. The borrowers then pay interest on their borrowed assets, which goes directly to lenders. The entire process is completely automated, with no intermediaries required, making it fast, cheap, and effective.

Lenders simply have to deposit one of the supported assets into a liquidity pool in order to get started. In return, they receive a liquidity token that represents a yield bearing version of the asset they deposited.

For example, if you were to deposit $1,000 worth of ETH, you would get an equal amount in aETH, the liquidity token that represents ETH. The interest rates that are generated vary depending on network activity and would be paid out in the form of that liquidity token, so your $1,000 worth of aETH would receive interest in the form of additional aETH.

To redeem your assets, you’d burn the liquidity token and receive the corresponding value of the original asset in return.

What about borrowing?

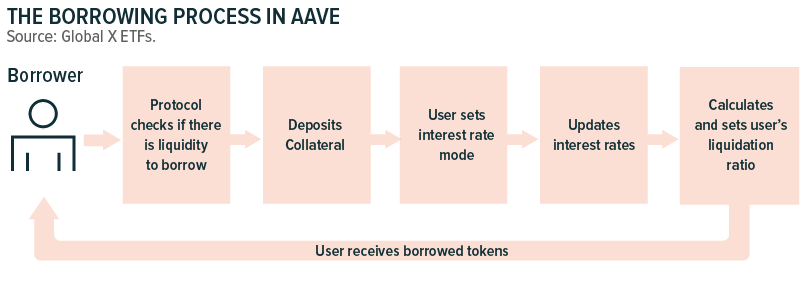

To ensure that the risk of bad debt is at a minimum, Aave requires loans to be overcollateralized, where users must provide crypto as collateral that exceeds the value of the loan, with the exact amount required being dependent on what asset and how much of it they are borrowing. The interest rate on the loan is then determined by Aave’s algorithm that checks the balances in the liquidity pools and sets an appropriate rate. Because they provided collateral, borrowers have much more flexibility with loan repayments.

Source: Global X ETFs

Another option for borrowers is an advanced technique called a flash loan, where the loan is taken out and then repaid within the same transaction. Generally, these flash loans are utilized through smart contracts that employ advanced trading strategies, such as token price arbitrage, to create leverage. Once the transaction is complete, the loan is returned to the pool it was taken from, and since this entire process occurred in only one transaction, Aave can audit it to ensure the loan was repaid in full.

Aave is completely decentralized and is operated through governance proposals where participants can vote on AIPs, or Aave Improvement Proposals, to govern the protocol. This type of protocol is called a DAO, or a Decentralized Autonomous Organization. DAOs are entirely controlled by their participants, who are all equally entitled to suggest and vote on improvements to the protocol. To become part of the Aave DAO, all you need to do is hold AAVE, the protocol’s token. This token is what allows you to create, review, and vote on proposals.

You do not need to be an Aave DAO member to use the protocol and all its features.

💡 The steps of Aave governance

- A proposal, that can be created by anyone in the DAO, is introduced to the community, and a temperature check called a snapshot is taken, which provides a sentiment gage and gives members the opportunity to offer feedback

- Proposals that successfully pass the snapshot are turned into official AIPs and are submitted on-chain to be voted on by the community

- Voting power is based on the amount of tokens you hold, where you would use your AAVE token balance as a way of supporting your vote on the proposal

- Successful proposals are then directly deployed onto the Ethereum network, which is the main network that Aave operates on, as well as then passed onto other networks in the form of smart contracts

To prevent potentially malicious proposals from being passed, elected members of the community called Guardians have the power to prevent harmful proposals from being passed, as well as other failsafe features that let them act in emergency situations.

To learn more about how the Aave protocol works, check out the Aave docs and Aave governance guides.

Lending and borrowing platforms such as Aave open up tons of new avenues for both lenders, who can earn interest on their money, and to borrowers, who have an effective and easy way to take out loans. For those that are unbanked, this is a particularly powerful tool, as they now have the ability to access capital for their endeavors.

📋 Practice Question