Wallet Asset Management

When you import an asset into your wallet, that asset becomes tied to the public key of the wallet, proving that the asset is, in fact, yours. This is because the wallet interface you see when using a digital wallet is only a representation of the assets, which are actually stored directly on the blockchain network. When a new wallet is created, the network creates the public key for that wallet, and all transactions done by the wallet will be associated with it. Any assets owned by that wallet will appear under that public key on the network, showing that they are held by the given public key.

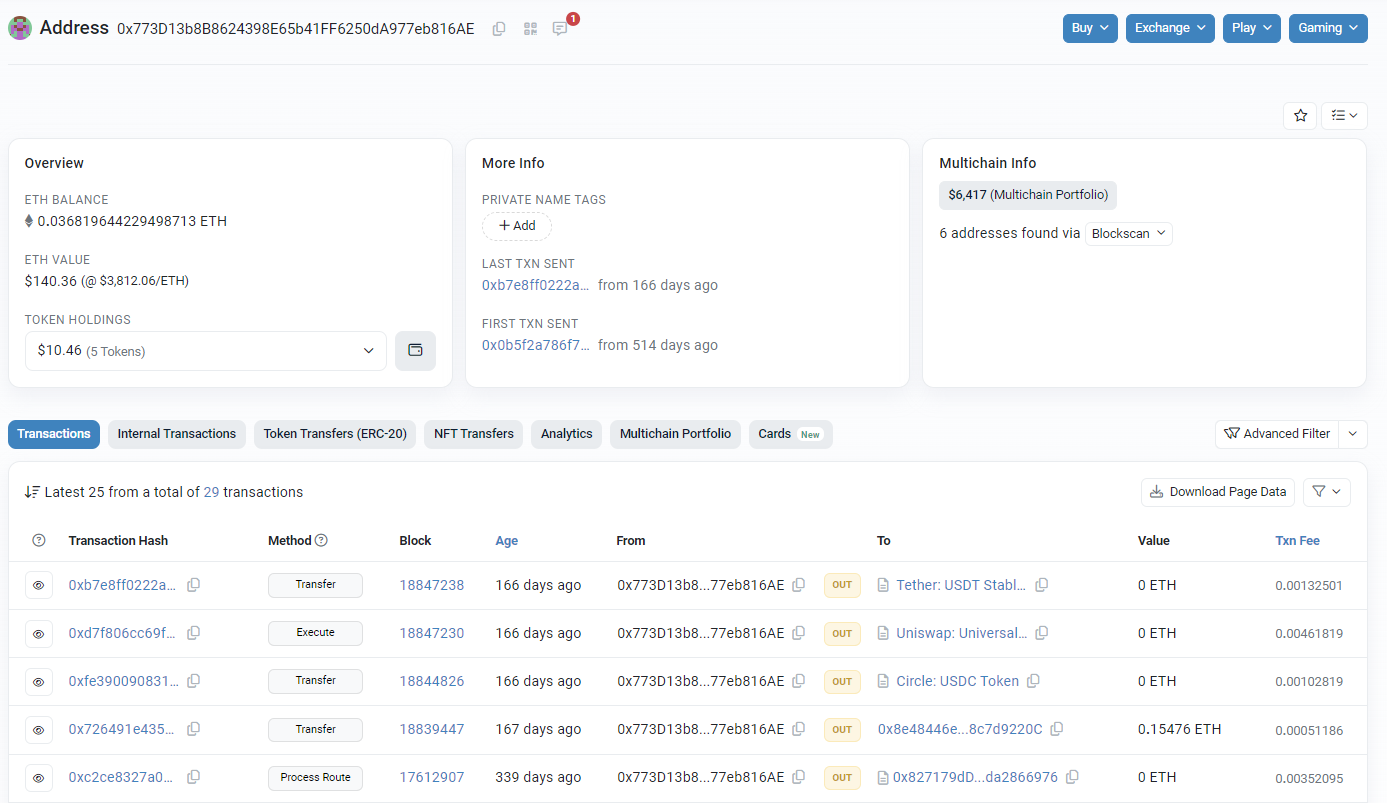

This image is an example what a digital wallet actually looks like on a blockchain network. All the transactions associated with the public key are listed, and the assets that wallet holds can be directly proven as being owned by that wallet.

For assets such as cryptocurrency, the amount that a wallet holds is based on the ledger system of transactions that keep track of the inflows and outflows of money to and from the wallet. If the wallet is receiving crypto, the allotted amount is deducted from the address sending it and added onto the balance of the receiving address. Vice versa, if the wallet is sending crypto, the allotted balance is deducted from the balance of the sending wallet and transferred to the balance of the receiving one.

Source: Etherscan

💡 Centralized vs decentralized money exchange

This process is similar to how banks transfer money between accounts today. There is no physical cash exchanging hands, it’s simply the bank updating the number that is displayed in the sender’s account. However, there are 2 key differences:

- Because of blockchain’s immutable properties (the hash changing anytime a transaction is edited), no one can fake or manipulate transactions. All money being transferred has been confirmed to be legit by the validators operating the blockchain network. This also means that you can directly view the transaction and all its details on the blockchain database; it would be like having access to the bank’s servers so that you can prove your transaction went through correctly.

- Because there are no middlemen involved, settlement time is near instant and the fees are significantly lower. Instead of waiting for days for money to be settled in your bank account, these types of transactions are available as soon as the validators confirm the blocks they are on.

For non-monetary assets, this system is an amazing way to immutably prove not only ownership of an asset, but also the validity of the asset itself. Imagine you buy an expensive oil painting painted by a famous artist. You would want to prove two things: you legitimately own the painting, and that the painting itself is an original and not a fake. Using a blockchain network, you can create a token, or a digital representation of the painting. The painting can be authenticated and proven to be the original copy, which will be represented by the token. Ownership of that token can then be transferred to your wallet, where the blockchain network will show proof of the transfer and that the painting does, in fact, belong to you.

This is exactly how NFTs, or Non-Fungible Tokens, work.

When you buy an NFT, the asset is represented as a one-of-one unique token. The ownership of that token is then transferred to you once you buy it, and you can use the blockchain network to prove that you do own the NFT. Now imagine if that NFT represented a house. Owning that token would be the equivalent of owning the deed to the house, and the house could be sold as simply as transferring that token from one wallet to another. This is the future of blockchain and immutable ownership of digital assets.

📋 Practice Question