Stablecoins

Stablecoins are tokens that are pegged to the value of existing fiat currency, which lets them match their value but with none of the actual drawbacks of fiat. Stables are generally backed by fiat currency or other real financial assets such as treasury bonds, giving them legitimate value and making them the preferred method of conducting payments on-chain because of their fixed price point unlike other cryptocurrencies that can be volatile in value. This has resulted in a massive boom of the stablecoin market, with the total market cap of stablecoins reaching over $160 billion as of June 2024.

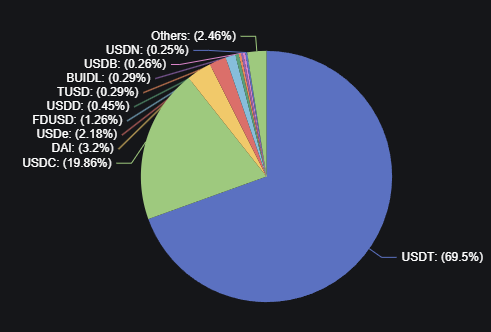

Source: DefiLlama

The largest stablecoin by market share is USDT, operated by Tether. USDT is entirely backed by the US dollar as well as government bonds and treasury notes. It dominates almost 70% of the stablecoin market with its closest competitor USDC, ran by Circle, making up 20% of the stables market. Other popular stablecoins include the DAI token by Maker, the USDe token ran by Ethena, and the PYUSD token operated by PayPal. Euro versions exist as well, with Circle operating EURC as a Euro stablecoin solution.

While tokens such as USDT and USDC are backed by fiat currency, other stablecoins are backed by crypto or completely algorithmically. The USDe stablecoin operated by Ethena is completely backed by crypto assets on-chain, making it transparent and fully decentralized. Feel free to read more about Ethena in the Ethena Labs documentation. Algorithmic stablecoins work by minting or burning tokens to control the price based on demand - when the price starts to go over the $1 point new tokens are minted (created) to dilute the supply, and when the price starts to dip below the $1 point tokens are burned (removed from circulation) to decrease the supply.

The goal of this stablecoin system is to create a completely digital currency that mimics the value of the fiat currencies that we are familiar with, but has none of the setbacks. It can be used by anyone, anywhere, at any time. USDC is also fully regulated and compliant and fully reserved, with the reserves for the token being transparently held and audited.

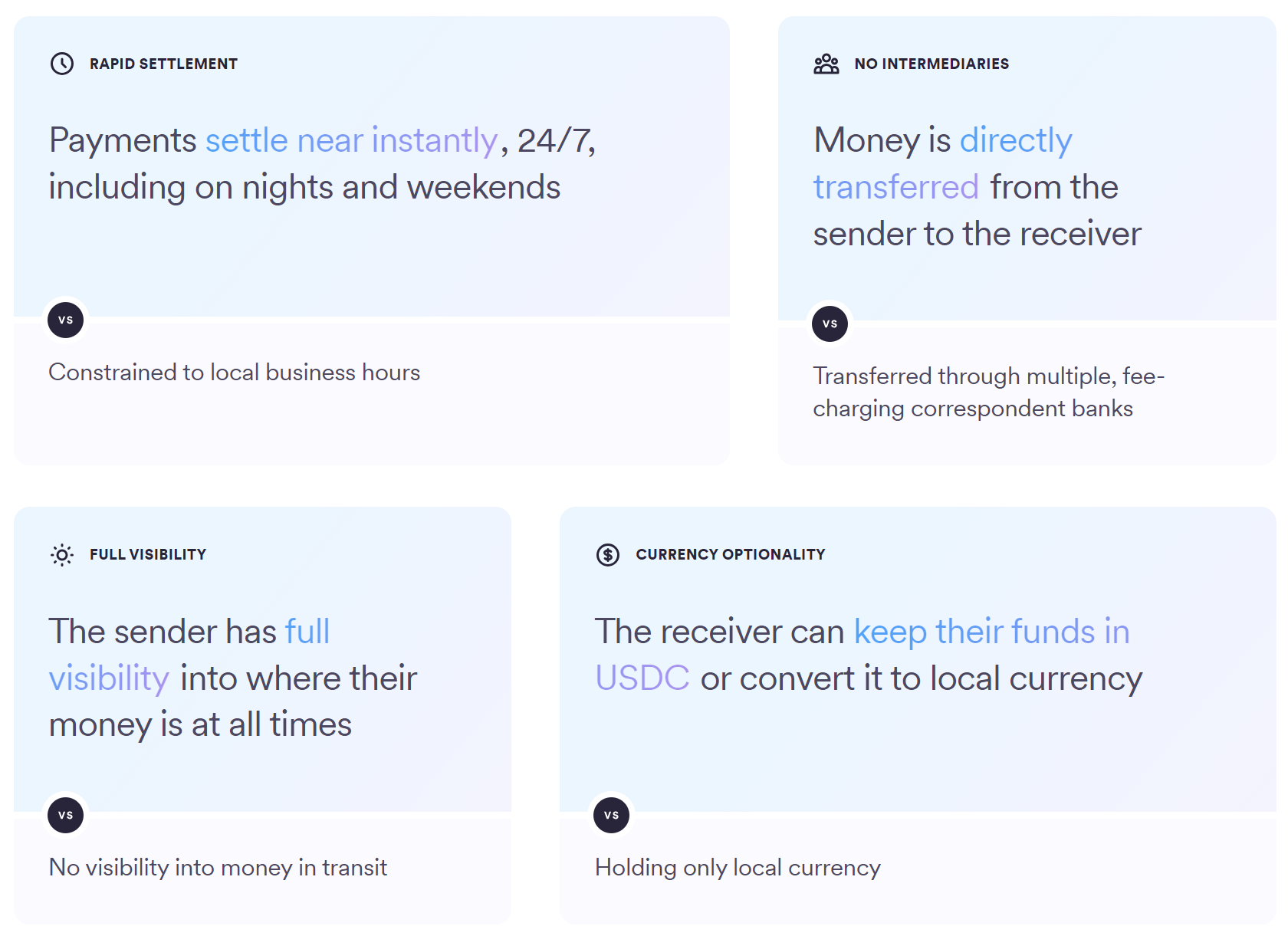

One major use case for this system is cross-border payments. Currently, this is something that creates major headaches for businesses and individuals alike. It requires going through multiple banks, long settlement times, and high fees. This is something that should not be a norm in the digital age. With stablecoins, users are able to harness the power of the blockchain to send money directly from one person to another with instant settlement time and minimal to no fees.

Because the liquidity for DeFi is provided by its users, stablecoins often offer much higher yield than savings accounts of CDs do on fiat currency. Protocols such as Ethena, Fluid, Kamino, Gearbox, and Goldfinch offer APRs of 10%+ for stablecoins because of this liquidity demand. This system benefits both sides of the ecosystem, where businesses have liquidity to operate while users get high and secure returns on their money.

💡 A word of caution on algorithmic stablecoins

While the technology behind these stablecoins continues to improve on a daily basis, algorithmic stablecoins are generally viewed as not being as reliable as collateralized stablecoins because they aren’t backed by legitimate assets. This became evident with the collapse of the Terra ecosystem in May of 2022.

Terra’s stablecoin UST was an algorithmic stablecoin that was controlled by the minting/burning of LUNA, Terra’s native token. A massive sell-off of UST caused the price to depeg from $1, causing a loss of investor confidence as the algorithm continued to mint more LUNA to try and bring UST back up to its $1 peg. The massive influx of LUNA into the market caused its price to plummet from almost $120 down to zero as investors sold off their holdings, causing the entire ecosystem to collapse. While new algorithmic tokens have taken precautions to avoid this scenario from ever occurring again, it’s important to know the potential downside of these assets.

Stablecoin pairs have become the dominant transaction medium for DeFi because of their price stability and security. They are available virtually on every chain, with both USDC and USDT being supported on over 70 different networks.

Source: Circle.com

Check out the current yield rankings for stablecoins on DefiLlama to see how much yield different protocols offer for their users to capitalize on.

📋 Practice Question